Q2 2024 Market Update

Florida

In Q2 2024, Florida’s real estate market continued to experience strong demand. Home prices increased by 1.6% compared to the previous year, with the average single-family home price surpassing $425,000. Despite this impressive price surge, there was a slight decline in the number of homes sold, totaling 78,756. Interestingly, the median days on the market decreased to 32, indicating a slightly faster pace compared to the previous year.

Key Trends & Predictions for the Rest of the Year

1. Population influx (demand) persists.

Florida continues to attract a substantial number of residents from other states, especially California, New York, and Illinois. They’re motivated by the warm weather, lack of state income tax, and appealing lifestyle. Popular destinations include Sarasota and Cape Coral.

In light of this, the state is anticipated to experience substantial population growth, which should keep the housing market buoyant, especially in urban and suburban locales. This steady influx of new residents will likely support real estate prices and prevent any significant downturn in the market.

2. Rise in carry costs affect where buyers are buying.

Increasing HOA fees, insurance costs, and property taxes are becoming significant concerns for residents, potentially affecting buyers’ decisions, particularly in high-demand areas like Miami and Tampa. There is a noticeable rise in days on market and price reductions for condo buildings over 30 years old.

3. Mortgage interest rates stabilize.

After peaking at 7.79% in October 2023, mortgage rates slightly declined to 7.35% in November. Analysts expect rates to remain above 6%, but stabilize in the second half of 2024, with the first rate decrease likely in September. This stabilization is attributed to a softening labor market, a slowing economy, and a decrease in the annual inflation rate.

4. Luxury buyers spike home prices.

Florida’s luxury property market is expected to remain robust in 2024, with high-end buyers from Latin America, Europe, and Asia driving demand. This trend is especially evident in Miami, which has emerged as a global center of finance, tech, and culture.

Properties on the waterfront and walkable neighborhoods are in high demand. But, due to rising land costs, buyers may also consider emerging areas such as Jupiter or Stuart on the Atlantic for more affordable luxury options.

5. Home construction sales are on the rise.

New construction is on the rise again, with builders offering attractive incentives and a shift back to traditional sales methods like “first come, first served.” This is a relief for buyers tired of bidding wars.

Although supply chain issues still present minor setbacks, they have significantly eased compared to 2023. This improvement in the new construction sector is crucial. It helps meet the persistent demand from various buyer segments, including retirees and young families looking for community-rich environments and good school districts.

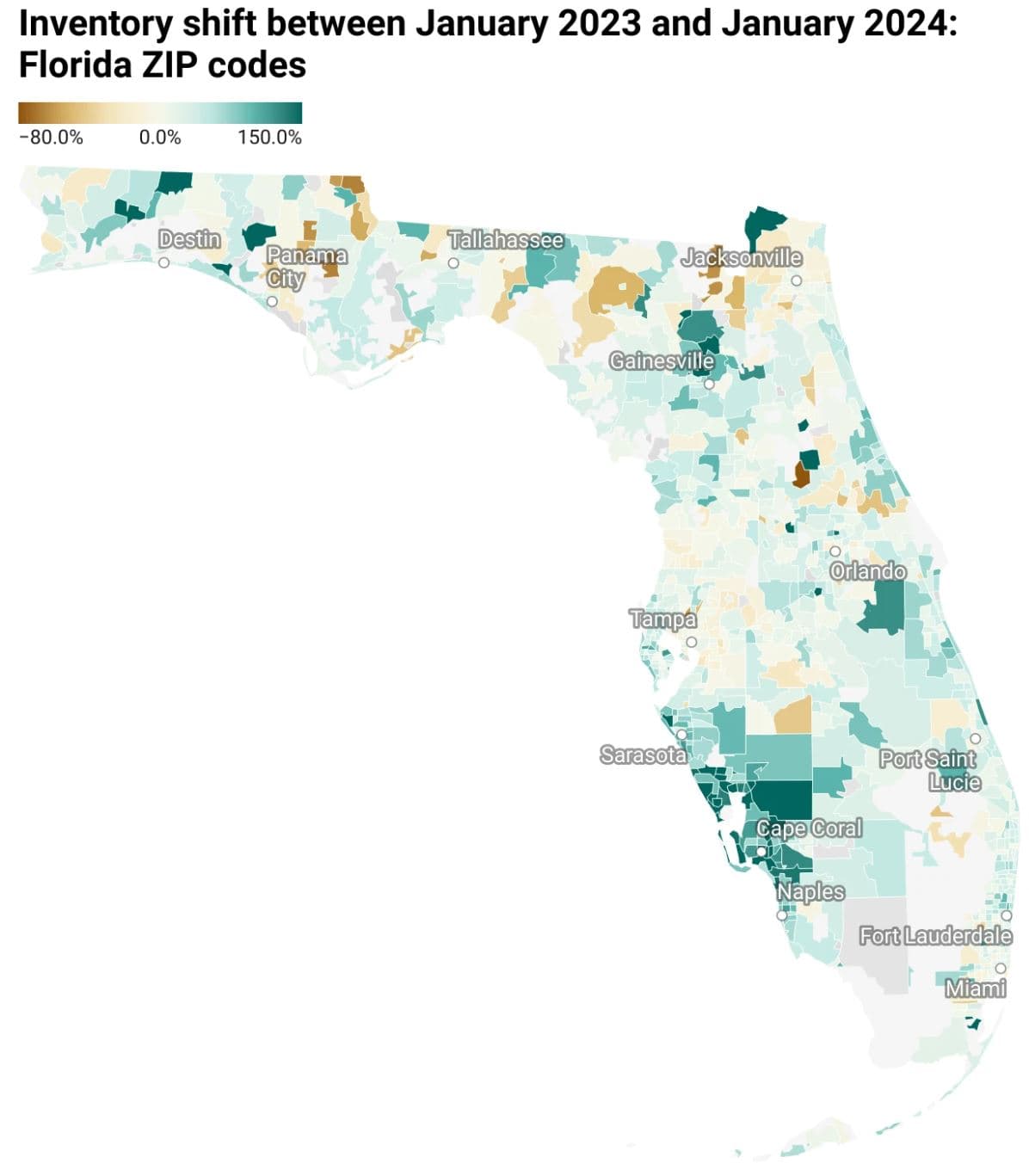

6. Home sellers make a comeback.

Analysts anticipate a resurgence of home sellers in 2024, especially among those who postponed entering the market in 2023. Factors like new job opportunities and the desire to move to more cost-effective areas are expected to drive sellers back into the market.

Additionally, experts like Meredith Whitney, who accurately predicted the 2008 financial crisis, project that baby boomers looking to downsize could contribute up to 30 million housing units.

In summary, Florida continues to be a focal point for real estate activity, with the upcoming year offering both challenges and opportunities for buyers, sellers, and investors. Expect a dynamic market landscape, marked by evolving trends and strategic shifts influenced by economic and demographic factors. Stay tuned!

Actionable Advice for Florida Agents:

- Plan for the election year.

Historically, the economy does not have large swings during presidential election years. Remind your clients that this is a good time to act. The election result may even affect the pulse of the DOJ, as they continue to observe the NAR settlement policy fallout. - Stay Florida Strong.

The Sunshine State remains one of the nation’s great economic growth stories. Keep an eye on your local market, new developments, and capital investments. This continual enhancement of Florida communities should continue to drive inbound demand. - Focus on listings.

Even with the turbulence in the industry on the buyer’s side, the listing side rules and expectations remain the same — the Exclusive Right to Listing contract is not under scrutiny. Take advantage of this and allocate an extra 10% of your time and marketing budget towards listings. - Communicate your value.

With the upcoming procedural pivot, it has never been more important to know and be able to communicate your value to prospective sellers or buyers. The days of an agent leaning primarily on charm to attract and maintain a dedicated client base is likely coming to a close. Educate yourself on the process and educate your potential client on your expertise. The cream in our industry will rise.

Q2 Key Stats to Keep Handy

Explore Other Market Updates

Partner with Side

Start the conversation.

By submitting your contact information, you agree to receive marketing communications from Side, including emails, calls, and text messages. Please review our Privacy Policy and Terms of Service for more details.