Over the course of 2022, the housing market has shifted considerably. We will be entering 2023 with very different market conditions — and possibly a recession to boot.

To get a better sense of what’s to come, we invited Rick Sharga, executive vice president at ATTOM, to deliver a fresh market forecast at a recent Side Masterclass.

Here’s a breakdown of Rick’s forecast, including:

- An assessment of whether a recession is inevitable

- His take on whether housing prices will drop in the near future

- Tips for how to communicate what’s happening in the market to your clients

You can also watch the full session on demand here.

Are we currently in a recession?

It depends on who you’re asking.

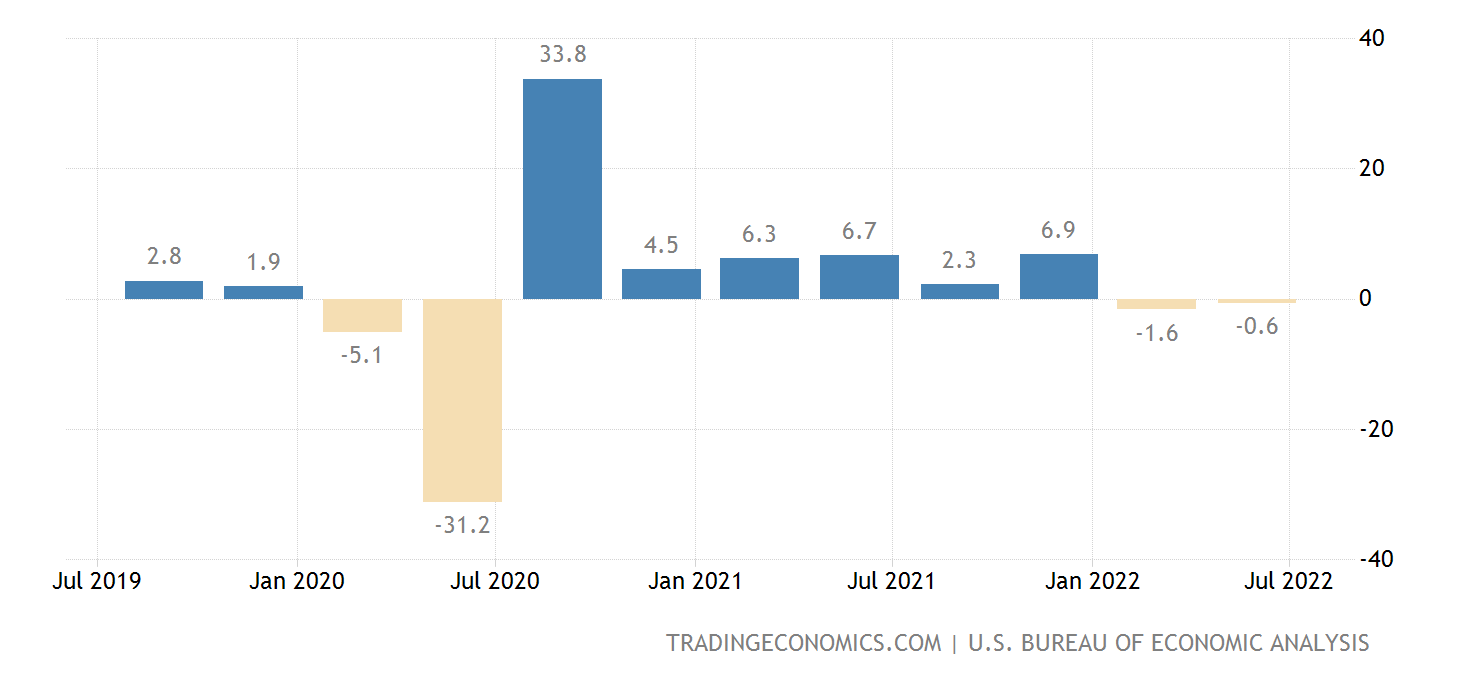

A recession is often defined as two consecutive quarters of negative GDP growth — which the United States experienced in Q1 and Q2 of 2022.

But at the same time, many other economic indicators remain strong. Employment has fully recovered the 22 million jobs lost early on in the pandemic, the job market is strong, and consumer spending continues to increase.

Because of those positive indicators, many economists — Rick included — don’t believe we are currently in a recession. But because recessions typically aren’t declared until well after they begin, it will be some time before we know for sure.

Are we heading for a recession in the next year?

It’s likely.

At 8.2% (as of September 2022), inflation is the highest it’s been in 40 years. High inflation lowers buyers’ purchasing power, having a particularly harsh impact on those in lower-income households.

The Federal Reserve’s main lever to combat inflation is raising the effective federal funds rate, which the Fed has done aggressively. We’ve never seen the Fed raise rates to such a degree in such a short period of time.

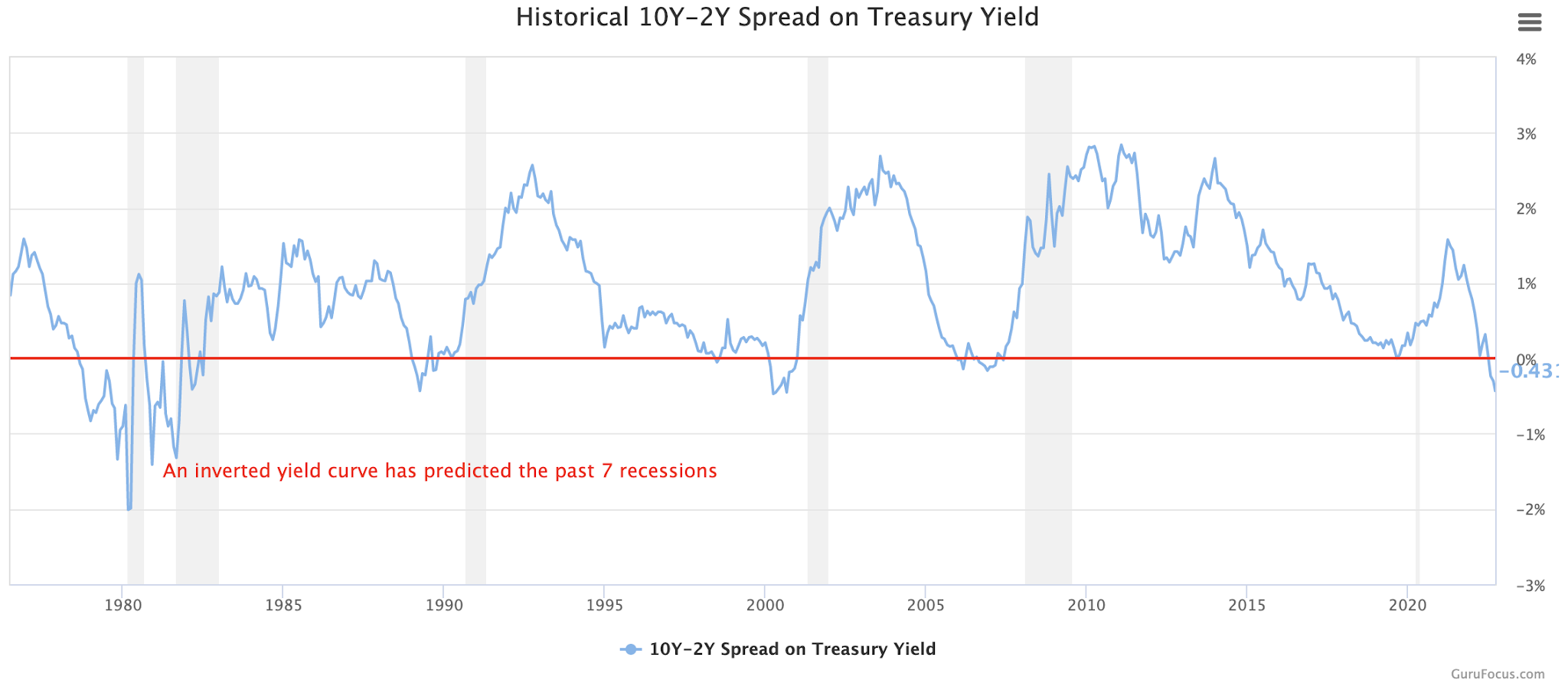

The sharp rate hike has created a yield curve inversion: a period of time where the interest rate on long-term investments switches places with the rate on short-term investments (represented on the graph below by the gray bands). For the past 40 years, every time we’ve had a yield curve inversion, a recession has followed.

While the inversion doesn’t guarantee a recession, it’s a strong predictor. Many economists, including Rick, believe the pattern will repeat and a recession is likely in our future.

If we do have a recession, how severe will it be?

Here’s the good news: Most economists believe the (possible) upcoming recession will be relatively mild and short-lived.

That’s because key indicators like job creation, unemployment rates, wage growth, and consumer spending are still trending positively, despite higher consumer prices and inflation. So if we do enter a recession, the economy should be able to pull us back on track.

How are higher mortgage rates impacting the housing market?

Demand is dropping.

According to Freddie Mac, we’ve never seen mortgage rates double in such a short period of time before. With 30-year, fixed-rate mortgages over 7%, the mortgage payment on a typical entry-level house is now 36% higher than it was just one year ago.

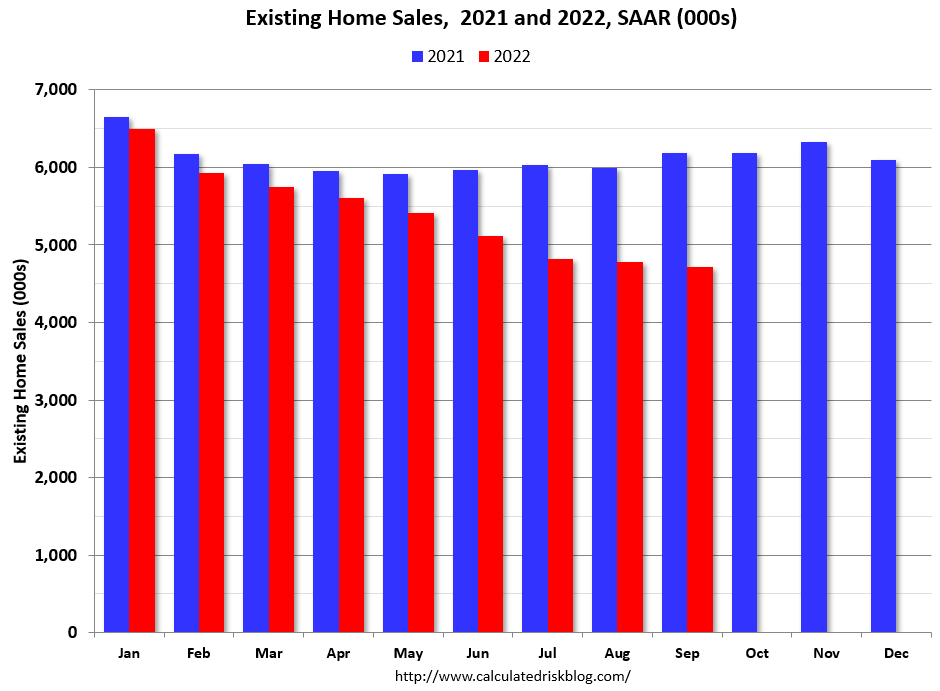

Buyers have struggled to adjust. September marked the ninth consecutive monthly drop in existing home sales, the longest streak since 2015. The Mortgage Bank Association’s purchase loan application index, which charts how many people are applying for mortgages, is down 22% from 2021.

Rick predicts mortgage rates are likely to stay between 7% and 7.5% for the rest of the year, suggesting demand will keep falling.

As a result, demand may start shifting towards rental properties. Data from John Burns Real Estate Consulting suggests that around 11% of prospective homebuyers have shifted focus to renting.

Is inventory rising?

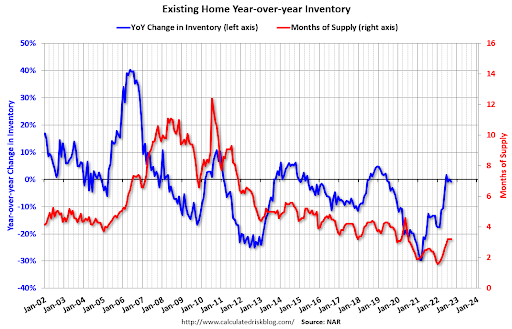

Not really.

You may have seen reports that inventory is going up, but that doesn’t mean new listings are coming on the market. Because demand has softened, properties are taking longer to sell once they hit the market.

Hence the unsold inventory index — the number of months it would take to sell all the inventory on the market at the current sales rate — has increased, even though listings have not.

Will housing prices drop this year?

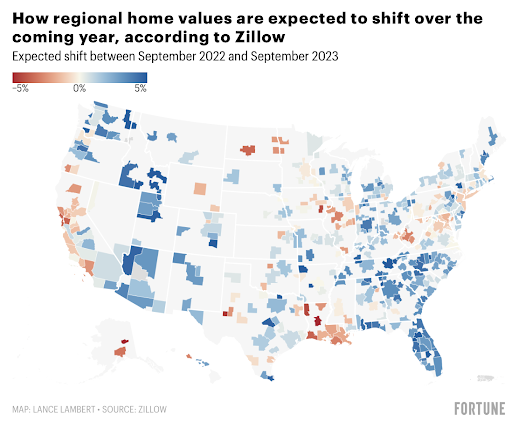

That depends on your market.

In a number of markets, home prices are already on the decline. In others — specifically those that were lower-priced to begin with and are now seeing positive population and job growth — prices are continuing to rise.

Also, in “Zoom towns” like Phoenix, Las Vegas, and Boise, where prices increased an astounding 40+% year-over-year, we’re likely to see some deceleration of the market.

Overall, NAR is forecasting prices will stay flat, while ATTOM is forecasting a 5% drop nationwide.

Are we approaching another housing crash?

It’s unlikely.

The main reason is lack of supply. A normal market has around six months of housing supply available; in September 2022, the inventory of unsold existing homes declined to 3.2 months. Compare that to just before the Great Recession, when the unsold inventory index peaked at 13 months: twice as many homes as the market can typically absorb.

And inventory is not expected to rise in the near future. Homeowners who are sitting on a sub-3% mortgage aren’t going to take on a 7% mortgage if they don’t absolutely have to.

So long as inventory stays constrained, prices should not drop by the drastic percentages we saw during the Great Recession.

How is new home construction being impacted by current market conditions?

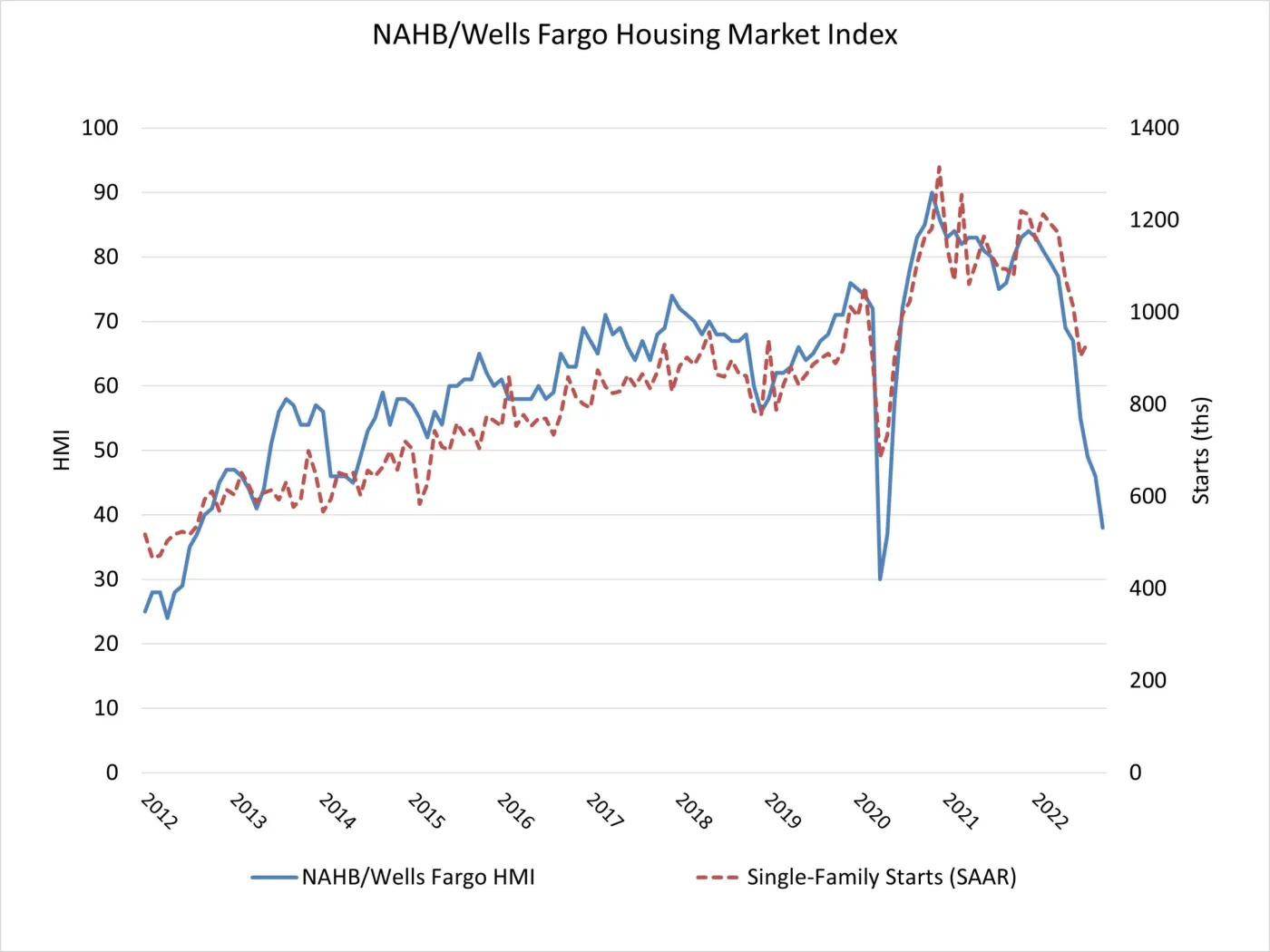

New home construction is slowing, too.

In October, homebuilder confidence fell to half of what it was six months prior. In response to rising mortgage rates, builders are cutting back on the number of homes they’re building. In July, new home starts dropped a sharp 18% year-over-year.

The good news is that even though new home starts are declining, multifamily starts are rising — which means builders are still focused on housing units.

Note that if you do see new home construction prices start to fall, it’s likely not because those homes are being discounted. Rather, builders are starting to shift their focus to smaller, less expensive homes.

Will there be a massive wave of foreclosures?

It’s highly unlikely.

The COVID forbearance program was incredibly successful in keeping foreclosures down. Around 4.4 million borrowers entered the program in early 2020, and that number has dropped to around 350,000 still in the program today. Almost no one in the program has actually gone into foreclosure.

In a normal market, around 1% of loans are in foreclosure; right now, only around 0.5% of loans are in foreclosure. That’s not expected to change soon.

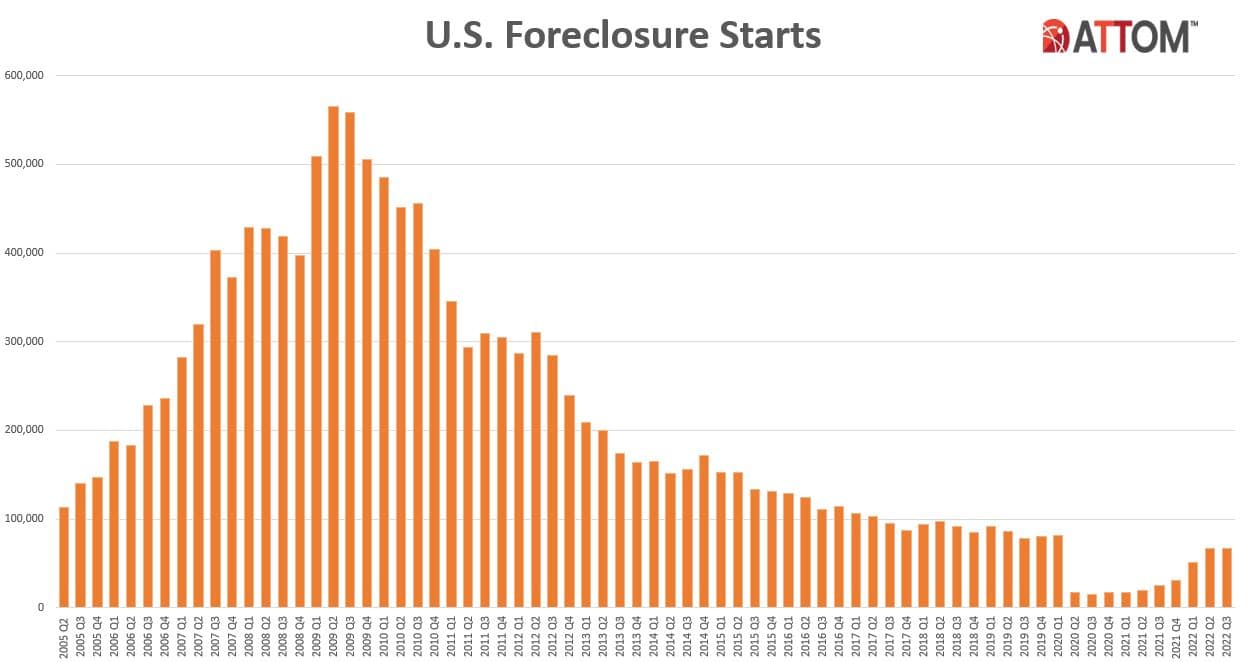

So while foreclosure starts have risen in 2022, they’re nowhere near the levels they reached preceding and during the Great Recession.

How can I reassure my clients about what’s happening?

1. Remind them: This isn’t 2008 all over again.

While a recession may be on the horizon, it won’t look anything like the Great Recession. Key indicators like job creation, unemployment rates, wage growth, and consumer spending are still positive, suggesting if we do enter a recession, it’s likely to be a mild one that won’t drastically slash housing prices.

2. Demystify the news with market-specific data.

What’s happening nationally may be wildly different from what’s happening in your local market — but chances are, your clients don’t realize that. This is a great opportunity to lead with your local market expertise and educate your sphere on how what they are reading in the news does or does not apply to their neighborhood.

3. Keep them focused on housing as a long-term investment.

If you have buyers concerned about the 7% interest rates, advise them that if they can find a home they can afford today, there’s a great chance that at some point in the next few years, they will be able to refinance at a lower rate. Rent, by contrast, will continue to increase and does not build equity. Historically, housing costs increase over time, even though they may dip here and there — so if you’re looking to keep the property for 5-10 years, buying a home remains a good investment.

How can I grow my business in this market?

If you’re a full-time agent willing to put in the work, this market presents an excellent opportunity to grow your business. Many part-time agents are likely to drop out of the industry as the market shifts, opening a window for you to capture their market share.

Perhaps more importantly: In a market like this one, which can be extremely confusing for the average consumer, your expertise in your local market is more valuable than ever. This is not a time to pull back on your marketing efforts — commit to differentiating yourself as the local market expert with clear, up-to-date market insights your clients can rely on.

What else do I need to know?

This forecast is not set in stone.

Ultimately, there are still many unknowns. As Rick said: “Until we have a better idea of what the recession might look like, if it happens, it’s difficult to forecast [the housing market] with any great sense of confidence.”

In the meantime, keep an eye on the news, stay up to date on what’s happening in your specific market, and keep your clients calm and informed. This market may be different from the one we started the year with, but it creates a real opportunity for excellent agents to stand out from the pack and grow their business.