When economist Rick Sharga talks, agents listen. And for good reason.

A year ago, when he spoke at Side x Side 2022 in Anaheim, he predicted the housing market would see a decline in demand, which would result in lower transaction volume in 2022 than in 2021.

He was right. Transaction volume fell from 6.1 million sales in 2021 to 5.1 million in 2022.

So when Rick took the stage once again as a keynote speaker at Side x Side 2023 in Long Beach, he captivated a packed house of top-producing agents with his latest predictions.

Here’s what Rick sees in store for 2023:

U.S. Economic Update

Perception vs. reality

It may have felt like the U.S. slipped into a recession in late 2022 — but Rick doubts it.

Rick said that no one he has spoken to believes that we were in a recession during the earlier part of 2022, even though we experienced two negative quarters in a row, which is the technical definition of a recession. Perhaps that was because those two quarters were followed by two consecutive positive quarters and all other economic indicators outside of GDP had been “very, very positive.”

A rosy picture (with a few red flags)

Remember: The housing market is just one indicator of how the economy is performing. Consumer spending makes up about 65% of the country’s gross domestic product (GDP), while housing only accounts for 15% to 17% of it.

“The economy, overall, is almost too strong, at least according to the Federal Reserve because of what’s going on with inflation,” Rick said, noting that employment has made a “remarkable recovery” from the COVID recession, compared to after the Great Recession.

“Unemployment numbers are now the lowest they’ve been in about 50 years. Job growth continues. Now, wages are also growing. And wage growth is one of the reasons I can paint a scenario that says the second half of 2023 will be better than the first half.”

“The economy, overall, is almost too strong, at least according to the Federal Reserve because of what’s going on with inflation.”

— Rick Sharga, Economist

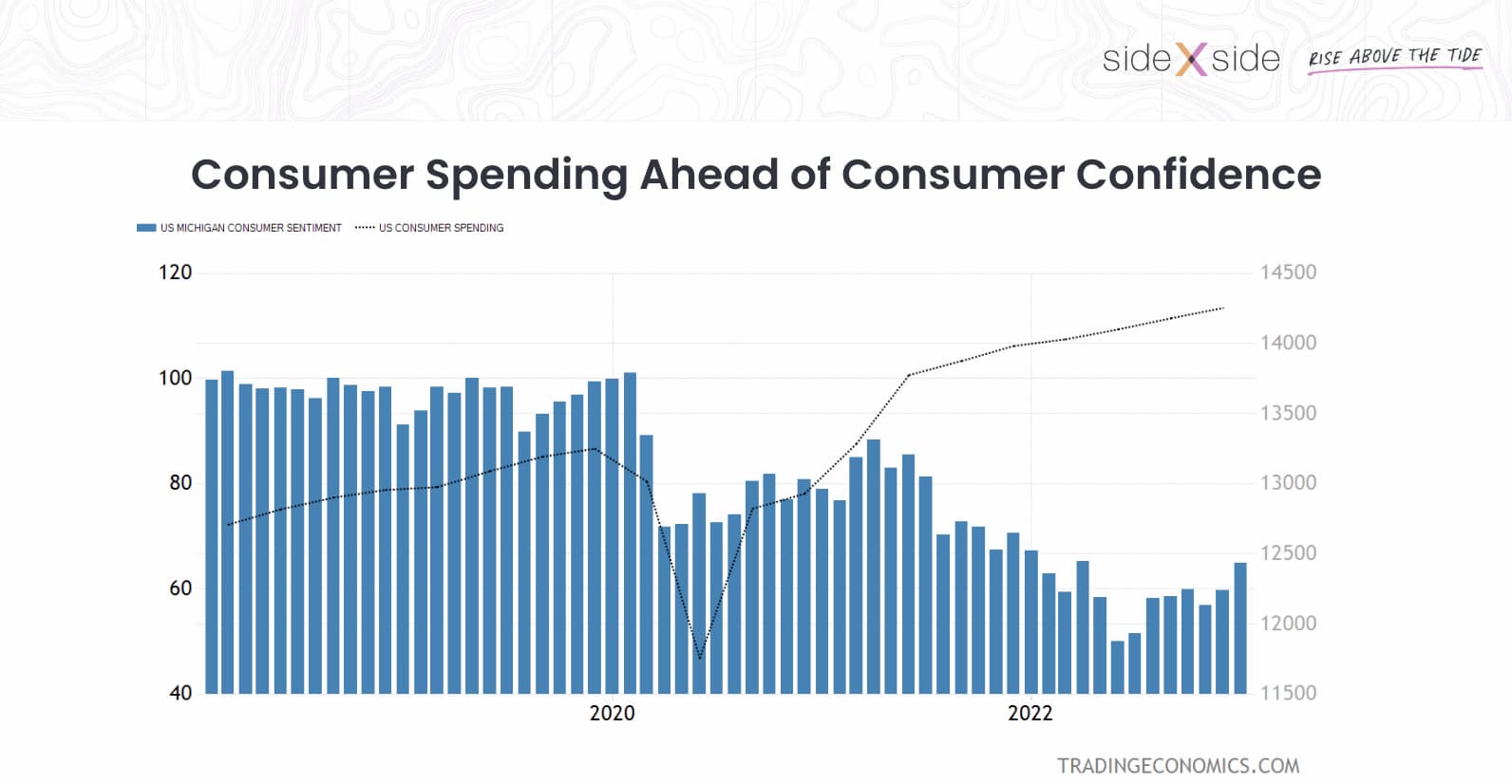

Rick also noted that consumer confidence is improving slightly after a year of historically low levels.

Even so, one “red flag” to keep an eye on is the disconnect between consumer spending and consumer confidence. The more confident consumers are, the more likely they are to spend money on long-term financial commitments like buying a house. While consumer spending dipped down during the pandemic, it picked up right after and hasn’t really slowed since. Consumer confidence, on the other hand, continues to lag.

Other “red flags” include consumers using their credit cards or dipping into their savings to pay for necessities, and saving money at a lower rate than normal, especially compared to during the pandemic.

Rick pointed out, “If you’re looking for an area of vulnerability in the housing market, look at the FHA portfolio.” FHA borrowers are most vulnerable to the “high-inflation environment we’re living in today” because they pay a higher percentage of their take-home pay for necessities that have become more expensive, including food and fuel.

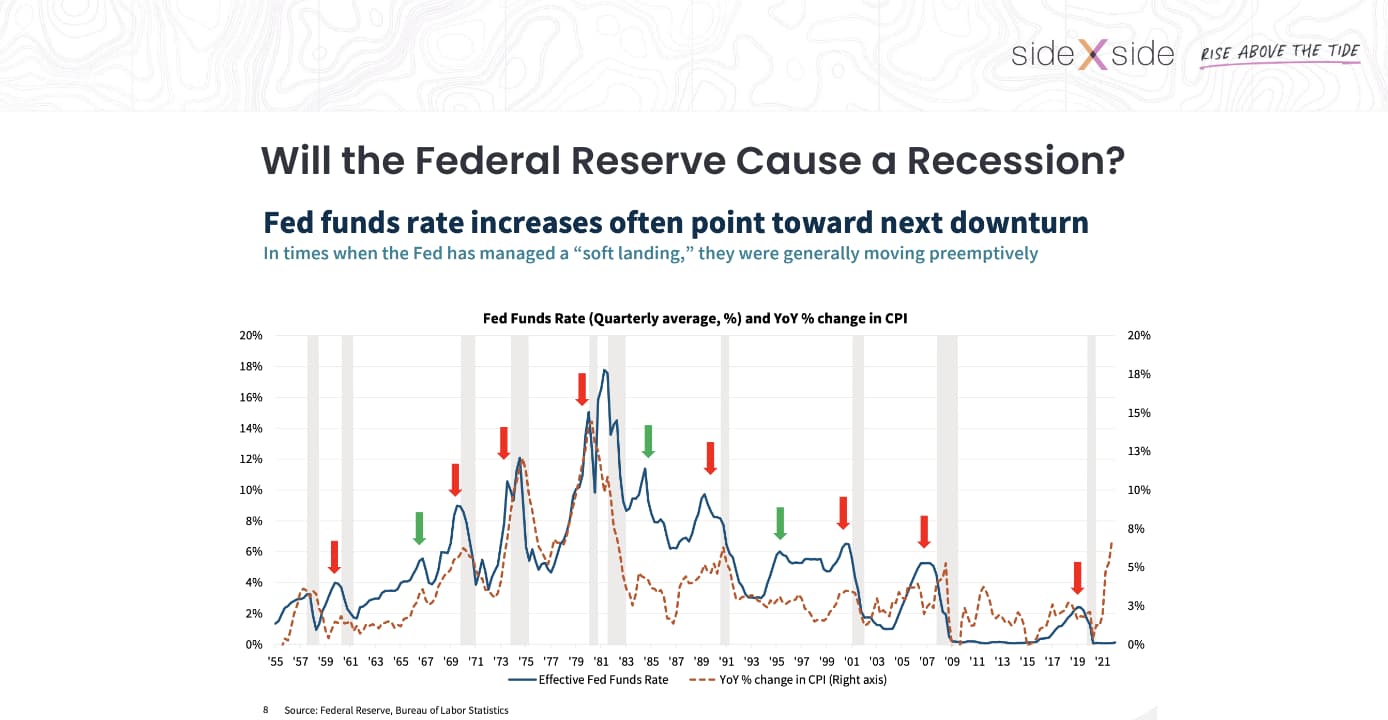

He then spoke about the “unprecedented series of actions by the Federal Reserve” that has thrown the financial markets into “a bit of a tizzy.” But while inflation remains historically high, he believes it may have peaked.

“The Federal Reserve can get less and less aggressive about raising the Fed funds rate … [the] aggressive actions [that] threw the market off its balance … and caused mortgage rates to double,” Rick said. “If we see the Fed back off a little bit, that should settle down the mortgage markets, which should improve affordability, which should make the housing market feel a little bit better next year.”

Are we out of recession danger?

Not exactly. According to Rick, a recession is still more likely than not in 2023 for two reasons:

- Overcorrection. Eight out of 11 times when the Federal Reserve has raised the Fed Funds rate in order to get inflation under control, a recession followed.

“This time around, they admitted they underestimated how high inflation was going to get [and] how hard it was going to be to get things under control.”The Fed seems to have things under control again, but this will be something to watch over the coming months.“As the economy shows signs of life, they worry it will stimulate more demand, which will cause inflation to go back up, which means they’d have to do more damage to the Fed funds rate,” he explained.

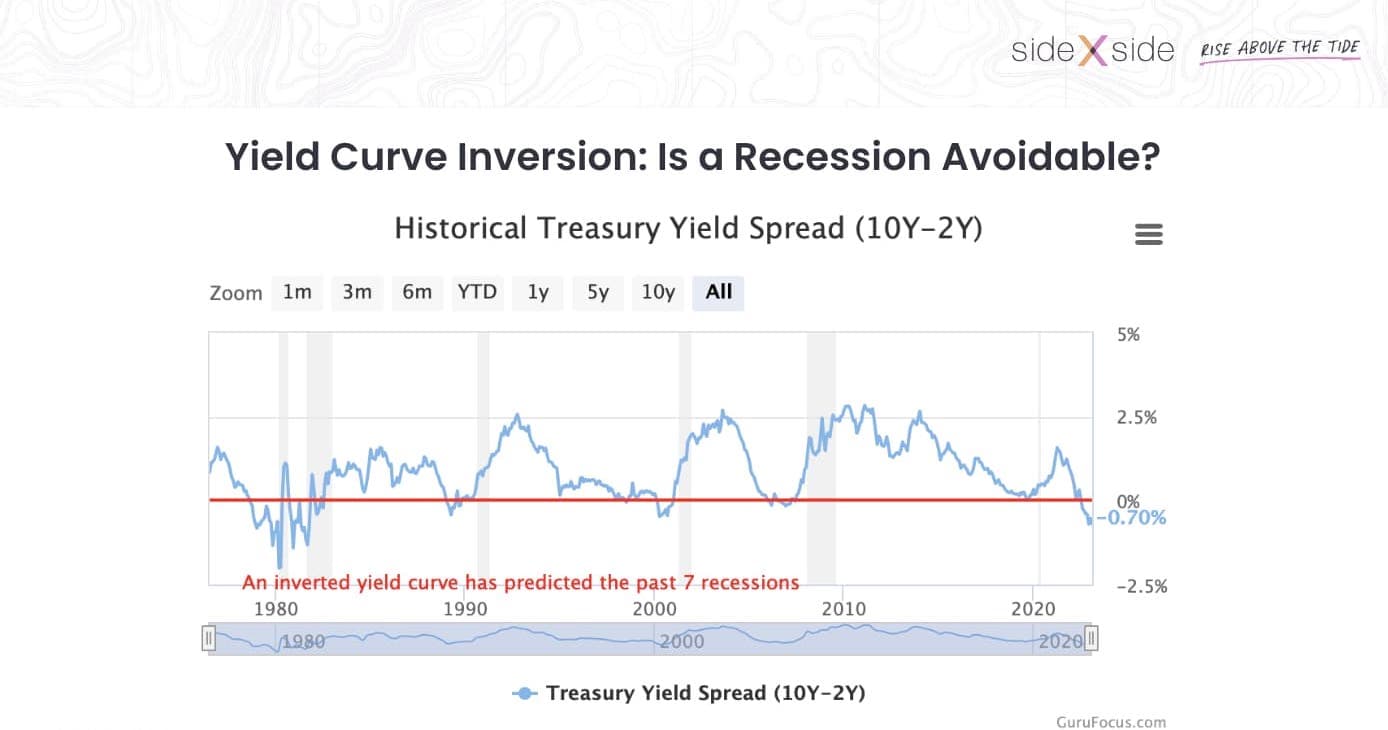

“This time around, they admitted they underestimated how high inflation was going to get [and] how hard it was going to be to get things under control.”The Fed seems to have things under control again, but this will be something to watch over the coming months.“As the economy shows signs of life, they worry it will stimulate more demand, which will cause inflation to go back up, which means they’d have to do more damage to the Fed funds rate,” he explained. - Yield curve inversion. The last seven times we’ve had a recession, it was preceded by yield curve inversion. What’s that?

Rick explained: “The yield on a two-year bond should always be lower than the yield on a 10-year investment, because its tenure represents a longer time to wait for the yield and more risk. So normally the 10-year yield is higher than the two year yield.“Every now and then, the markets get screwed up and those two switch places. And so the yield on a two-year bond today is [above 4%]. The yield on a 10-year bond is [below 4%]. They call that a yield curve inversion …. We’ve been [experiencing] one now for several months, and it’s a pretty significant one.”

Ultimately, even if the United States does enter a recession in 2023, Rick believes it will be fairly short and mild.

U.S. Housing Market

High interest rates and low demand

Mortgage rates hitting 20-year highs have “crushed affordability,” said Rick. We’ve never had a market that’s had to adjust this quickly to such a dramatic increase.

“In a normal market, interest rates or home prices go up gradually and buyers can adjust,” Rick explained. “A buyer might decide they can’t afford that $500,000 house and look for a $450,000 one. This time, the $500,000 buyer was suddenly looking at $250,000 homes and there just wasn’t a lot of inventory available.”

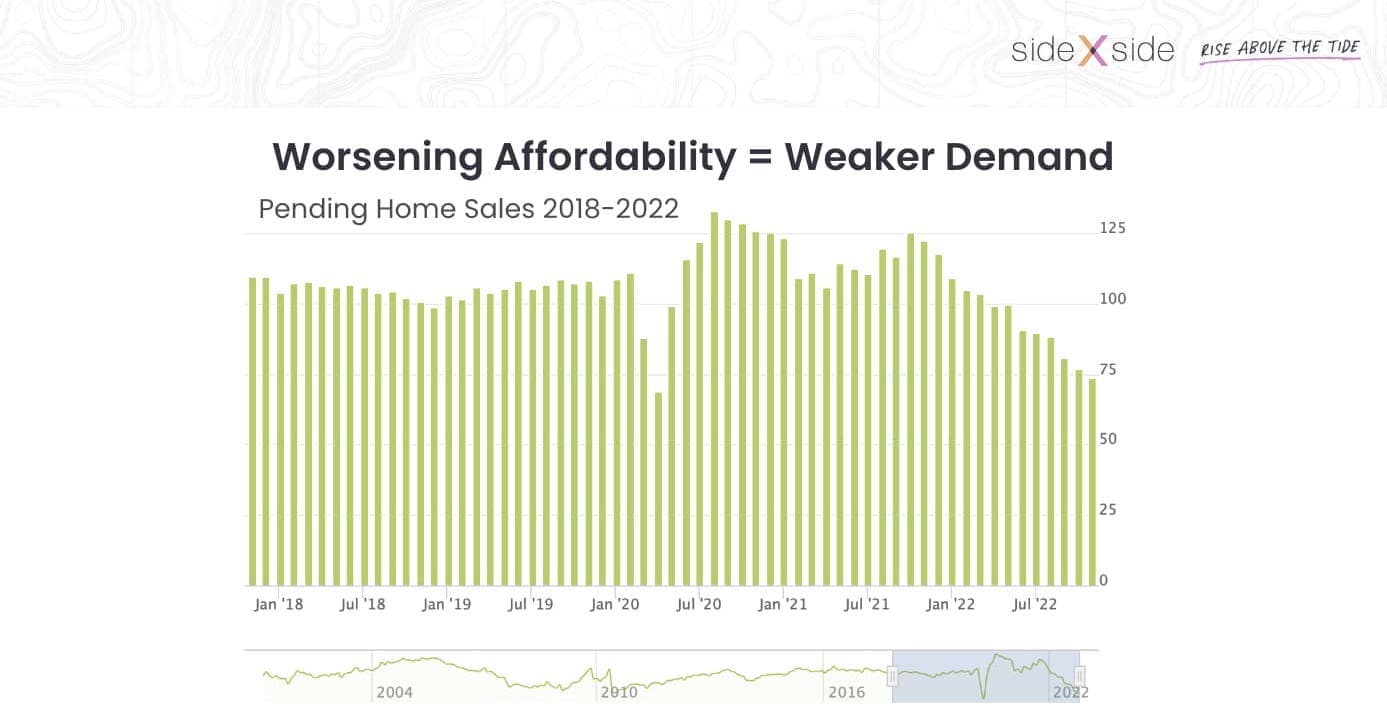

Worsening affordability has also impacted demand.

Every month of 2022, there were fewer existing homes sold than the prior month. “I’ve never seen that happen before,” Rick said.

In addition to home sales being down 18% across the country year over year, purchase loan activity is 41% year over year.

The promising news is that Rick believes interest rates have already peaked and will gradually lessen until we’re down in the 5% range by the end of 2023. On top of that, as wages grow, home prices have plateaued or slightly declined.

“That psychologically makes buyers think it might be time to come back to the market,” he said. “I do believe we’re going to see a stronger second half than first half this year, and that 2024 will be a good year for growth.”

“I do believe we’re going to see a stronger second half than first half this year, and that 2024 will be a good year for growth.”

— Rick Sharga, Economist

Cash buying & the second-home market

In Q4 of 2022, 41% of residential sales across the country were cash purchases. Rick predicted that this trend will likely continue until market conditions normalize.

“Last year we saw an unusual number of people that owned a second house,” he added.“This might be an Airbnb phenomenon – people deciding they’re gonna get rich on a rental.”

According to Rick, 90% of single-family homes that are being rented out today are owned by mom-and-pop investors who own and manage multiple properties. This high percentage could be attributed to the work-from-home movement.

According to Rick, this trend has helped result in $29 trillion in homeowner equity across the country.

“About 50% of homeowners are what we call equity rich. That means they owe less than 50% of the value of the house on their mortgage. So [there’s] a ton of equity out there.”

Low inventory

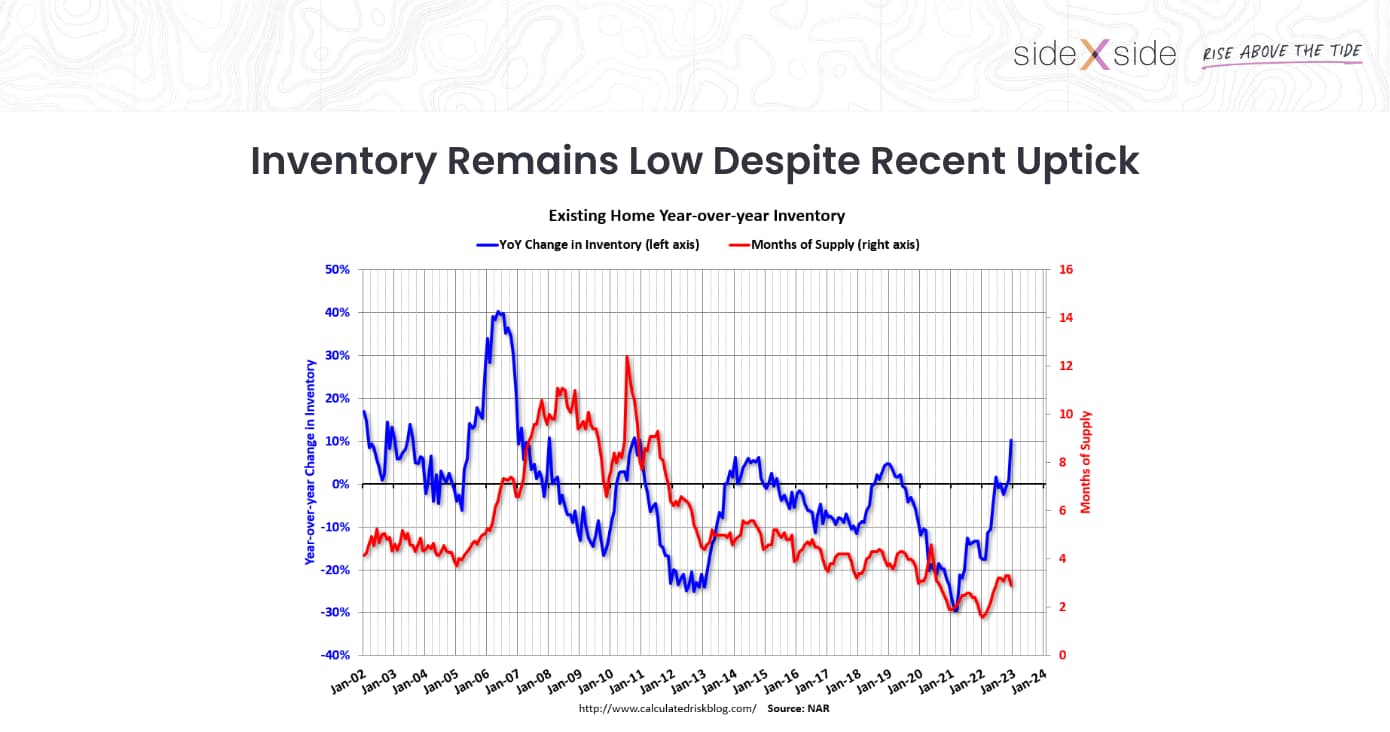

Even with lower demand for houses, there isn’t enough supply to go around.

Rick said that in a normal market, there’s about a six-month supply of existing homes available for sale. In today’s market, there’s around a three-month supply. In some states, it’s even lower than that.

Part of the reason is that fewer and fewer people are listing their homes for sale than a year ago — a trend that Rick said will likely continue at least through 2023.

Why? Because if you’re a homeowner who has a 3% mortgage, and you’re facing the prospect of buying a more expensive home with a 6.5% mortgage, you’re not going to move — a phenomenon Rick and other economists call “rate lock.”

New construction

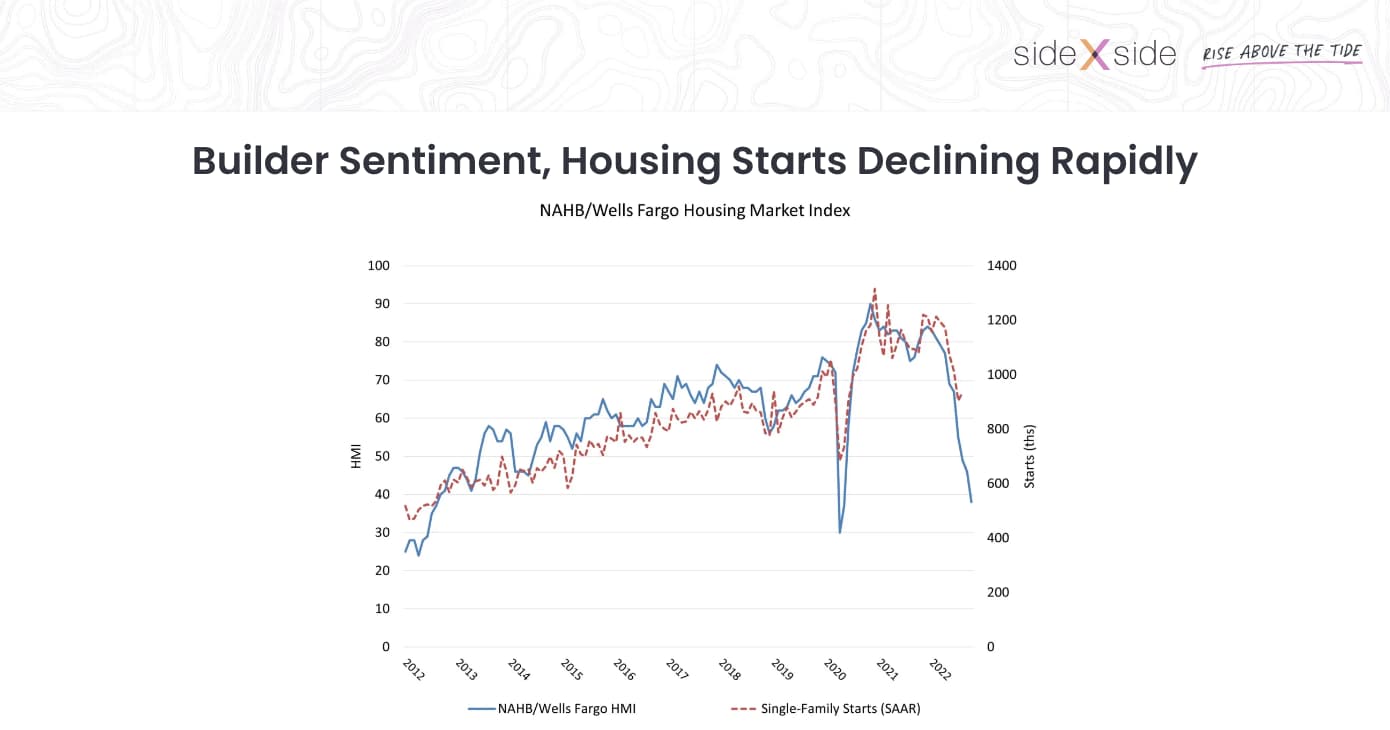

Worsening affordability is also reducing demand for new homes. As houses sit vacant month after month, they’re costing builders money. As a result, builders are lowering prices, offering concessions and paying money at closing to buy down interest rates.

According to Rick, “Housing start numbers have been going down by double digits month over month since July.” New-home sales are down 16.4% from 2022.

But, unlike in 2008, this time builders stopped building when buyers stopped buying. December 2022 new-housing starts were down 21.8% year over year.

Rick pointed out that we have the highest number of homes under construction (since we started tracking the number in the ’70s), but the lowest number of new homes that are finished and available for sale. This is, in part, due to supply chain disruption and labor shortages.

“This inventory will come to market gradually over the course of the year, but there is nothing coming behind it,” Rick said.

Interestingly, new construction on multi-family units increased by 18%. Rick said we will likely see a record number of multi-family units enter the market this year, which is a good thing, since inventory is low in the rental market as well.

Prices

Prices were going up by 21% when we had really low interest rates, unprecedented demand, and not enough supply. But, even with the drops we’ve seen month over month, Rick said prices still increased around 7% year over year.

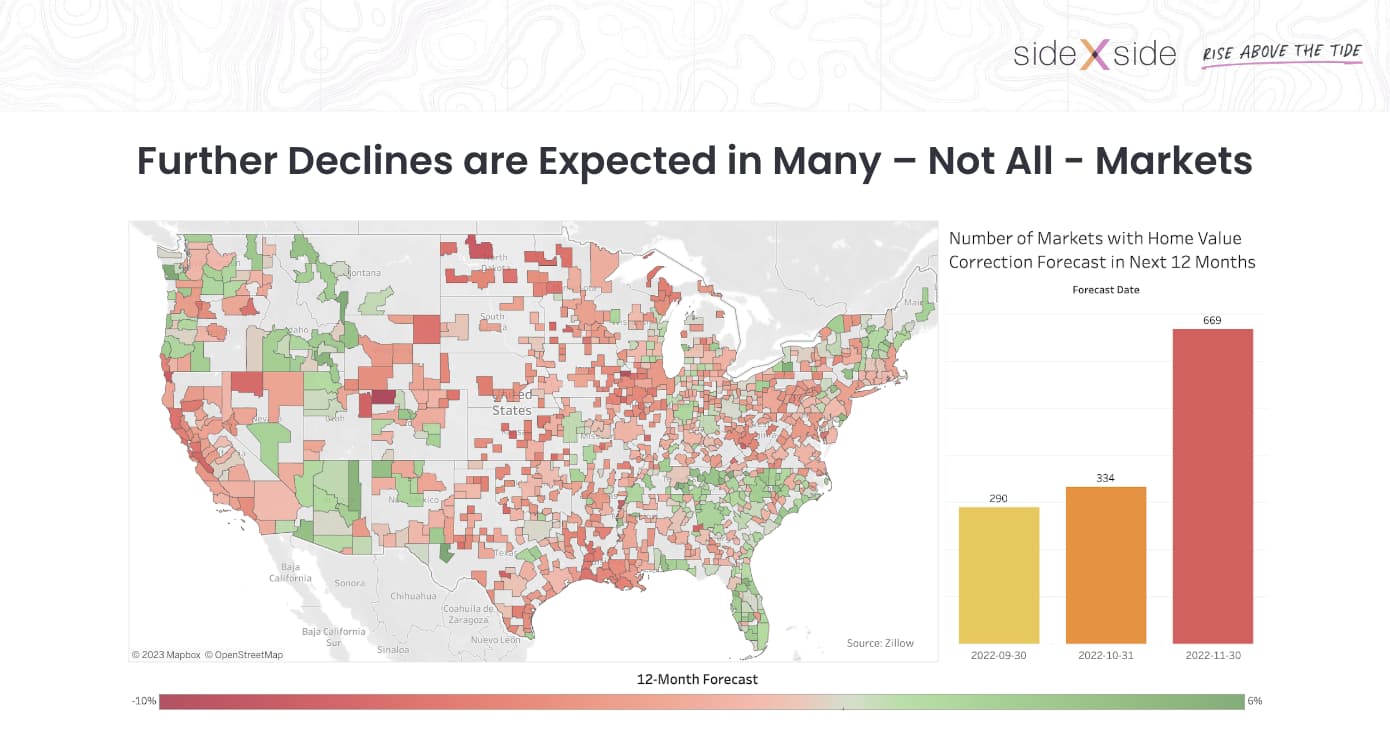

“I’m not forecasting a huge drop-off in prices this year, but I wouldn’t be surprised if we saw home prices drop maybe by 5% nationally. The reality is we’re going to see very different conditions across the country … a very, very localized and regionalized price correction.”

Rick also said that it looks like list price reductions have finally peaked and are slowing down, which indicates either that people are pricing their homes more realistically or that buyers are willing and able to spend a little bit more money.

In some areas of the Southeast, such as Tennessee, the Carolinas and Florida, Rick said he wouldn’t be surprised to see housing prices go up in 2023 due to population and job growth.

The California Housing Market

Rick spent some time focused specifically on the California housing market, which he sees as a bellwether for the nationwide market. “In many ways, California home sales are a microcosm of what we’re seeing across the country. If we’re going to see price declines, it’s probably going to be at some of the higher levels.”

Unlike areas of the Southeast that are growing, California actually lost 300,000 people last year. And for the first time in three years, prices fell.

“In many ways, California home sales are a microcosm of what we’re seeing across the country. If we’re going to see price declines, it’s probably going to be at some of the higher levels..”

— Rick Sharga, Economist

“The number of properties being sold at or above list price was down to 96%,” said Rick. “Still very, very strong, but the lowest it’s been in 10 years. I don’t know that we’re going to see that turn around anytime soon.

He explained that the California market tends to be a bit more volatile with its swings. Prices push higher than in other markets when the market is good and fall a bit faster when the market is not.

The California Association of REALTORS® has predicted that we’ll see about a 10% price decline across the state in 2023.

Rick said that if you’re in high-end markets like the Bay Area and some of the more expensive coastal communities, you’re likely to see a steeper price decline than you’ll see in the mid-tier and lower-tier markets.

California sales were down 44% year over year in December 2022 at every price point, Rick said. But the drop-off was the lowest at the lowest price tiers. He believes this is a trend we’ll continue to see.

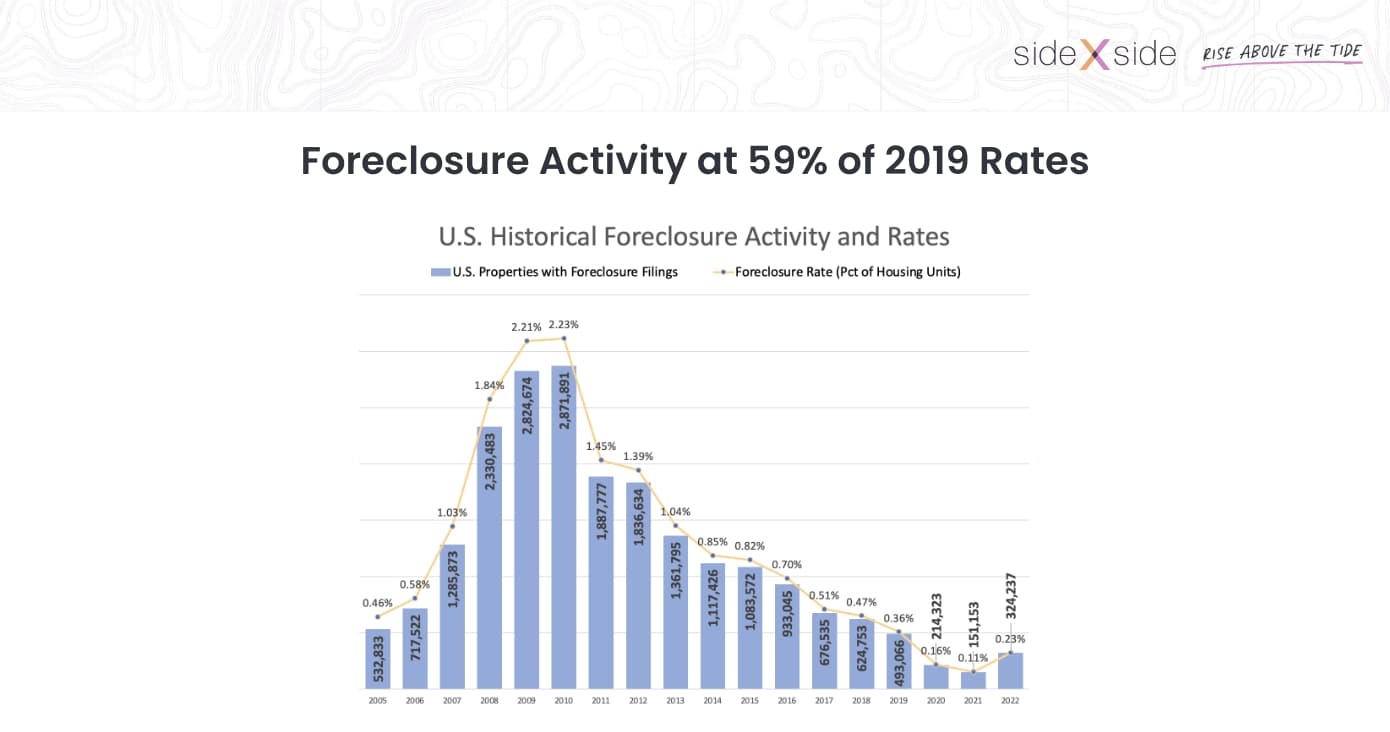

Foreclosures

A sign of strength in the housing market, according to Rick, is the record-low level of bank-owned properties and distressed properties sold in the last year.

Mortgage delinquencies are actually lower than they are normally, with just about 3.5% of loans delinquent.

“Delinquencies are a great predictor of what’s likely to happen in terms of foreclosure volume and foreclosure activity across the country,” Rick said. “You will see headlines that state that foreclosure activity is up 150% year over year. But it’s up from historically low numbers when almost nobody was in foreclosure.”

Rick said foreclose starts are back to about 80% of pre-pandemic levels.

“As more people enter foreclosure, and 93% of them have positive equity, a lot of them don’t know they have the option to sell their house and avoid a foreclosure,” he said.

While foreclosure starts are almost back to normal levels, foreclosure completions and bank repossessions are still only at about 30% of where they were prior to the pandemic. Rick believes this suggests that more borrowers are leveraging the equity they have to either refinance their loan or sell their property before they lose it to the foreclosure auction.

Of the properties that are going to auction, 60% to 70% of them are selling at auction, compared to just 30% to 35% prior to the pandemic. Rick cautioned agents who work with investors to be mindful of low inventory and high competition at the auction, and to reach out to distressed homeowners in the early stages of foreclosure.

“Reaching out to those people can be a win-win. You can help them avoid losing all that equity to a foreclosure sale, and you can get yourself a profitable listing in the process.”

Market Outlook for 2023

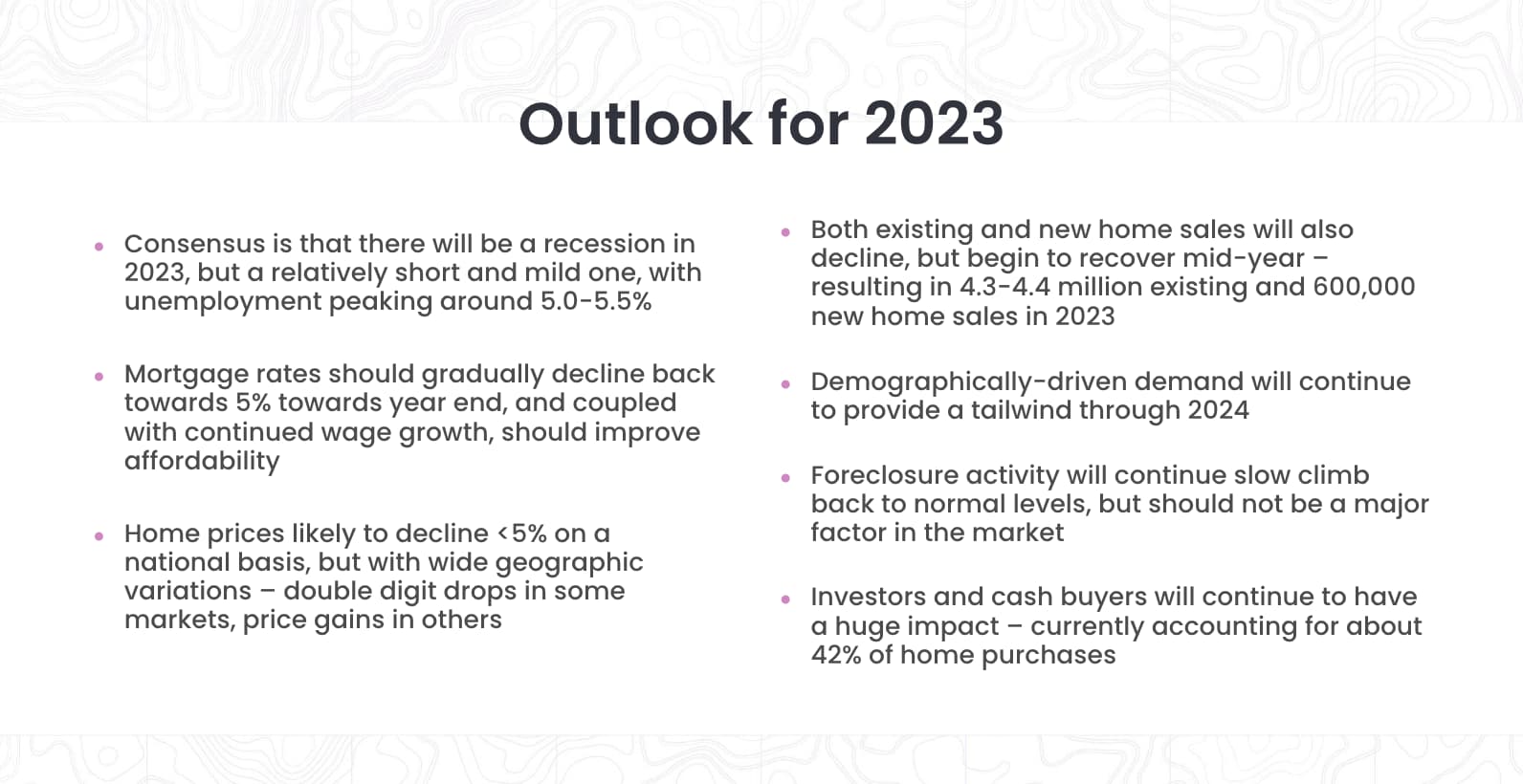

Rick wrapped up his Side x Side 2023 keynote by forecasting that, in 2023, agents would neither experience stormy seas nor smooth sailing, but rather something in between.

“You’re going to have a few waves, maybe a couple squalls.”

Rick’s prediction summary:

- There will be a recession in 2023. It is likely to hit during the second quarter and be relatively short and mild.

- Mortgage rates have peaked. They will probably gradually decline throughout the year and reach the 5% range by the end of 2023. And this will help move the needle with home sales.

- Cash buyers and investors, whose purchases account for 40% to 42% of all residential sales across the country, will continue to have a significant impact on the market.

- Home prices will likely decline 5% or less nationally. But it will be a very localized correction. In some markets, they may increase by 5%. This is where you need to be the local market expert and guide your buyers and sellers.

- Both new and existing home sales will continue to decline (4.3 to 4.4 million existing homes sold compared to 5.1 million in 2022). This is due to lack of affordability and lack of inventory.

- Tight market foreclosure activity won’t be back to normal levels until late this year.

The optimistic takeaway

Things are going to get better with time. Rick believes the second half of 2023 will be better than the first half, and 2024 will be better than 2023.